See What Injala Has To Offer

Injala offers a comprehensive set of risk management tools to support all of your needs, seamlessly integrated under a single sign-on.

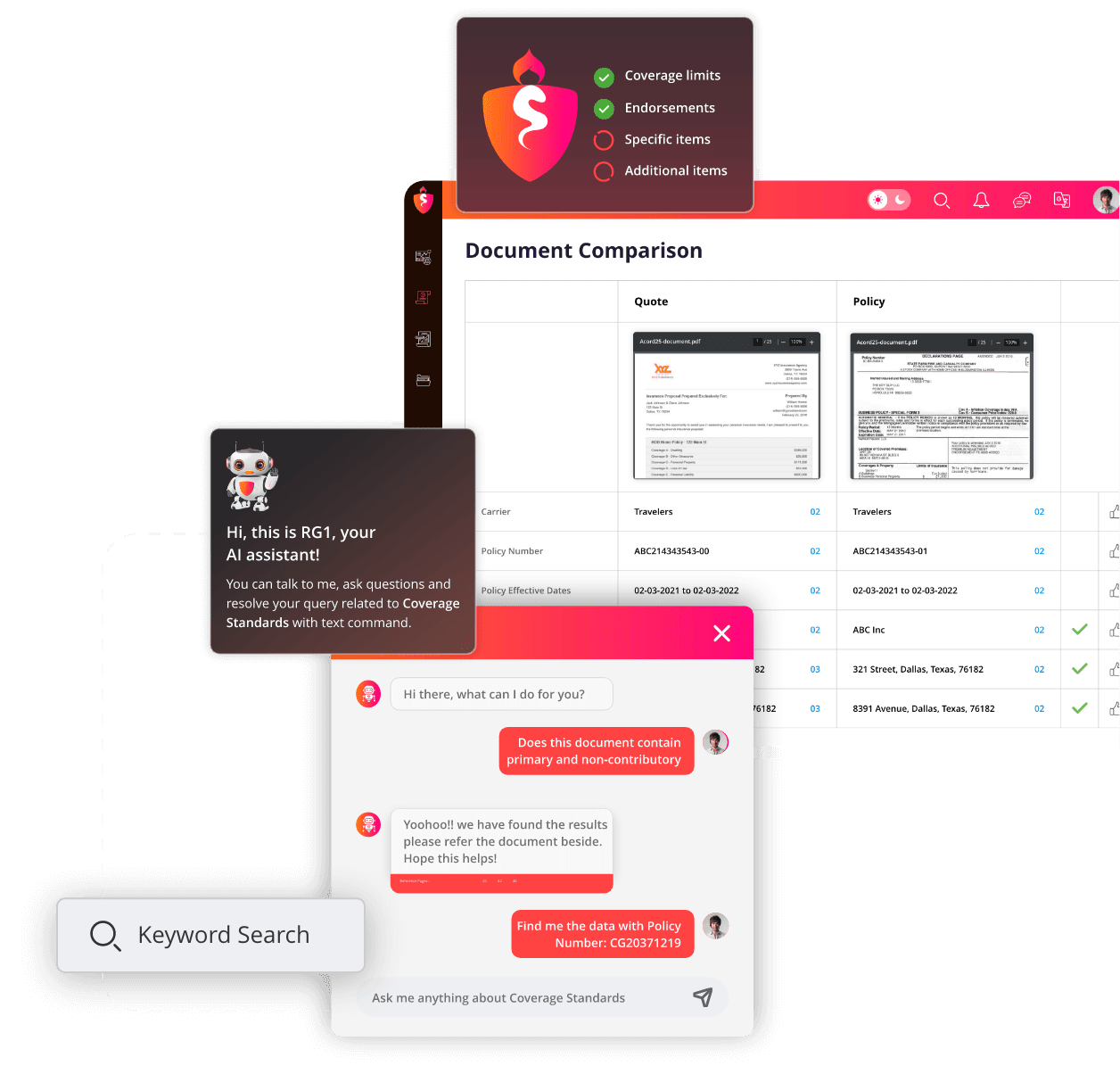

Leverage artificial intelligence to review COIs as well as full policy documents, endorsements, and more, in under a minute.

Master your insurance administration with an all-in-one solution for managing Master Builders Risk and specialty programs.

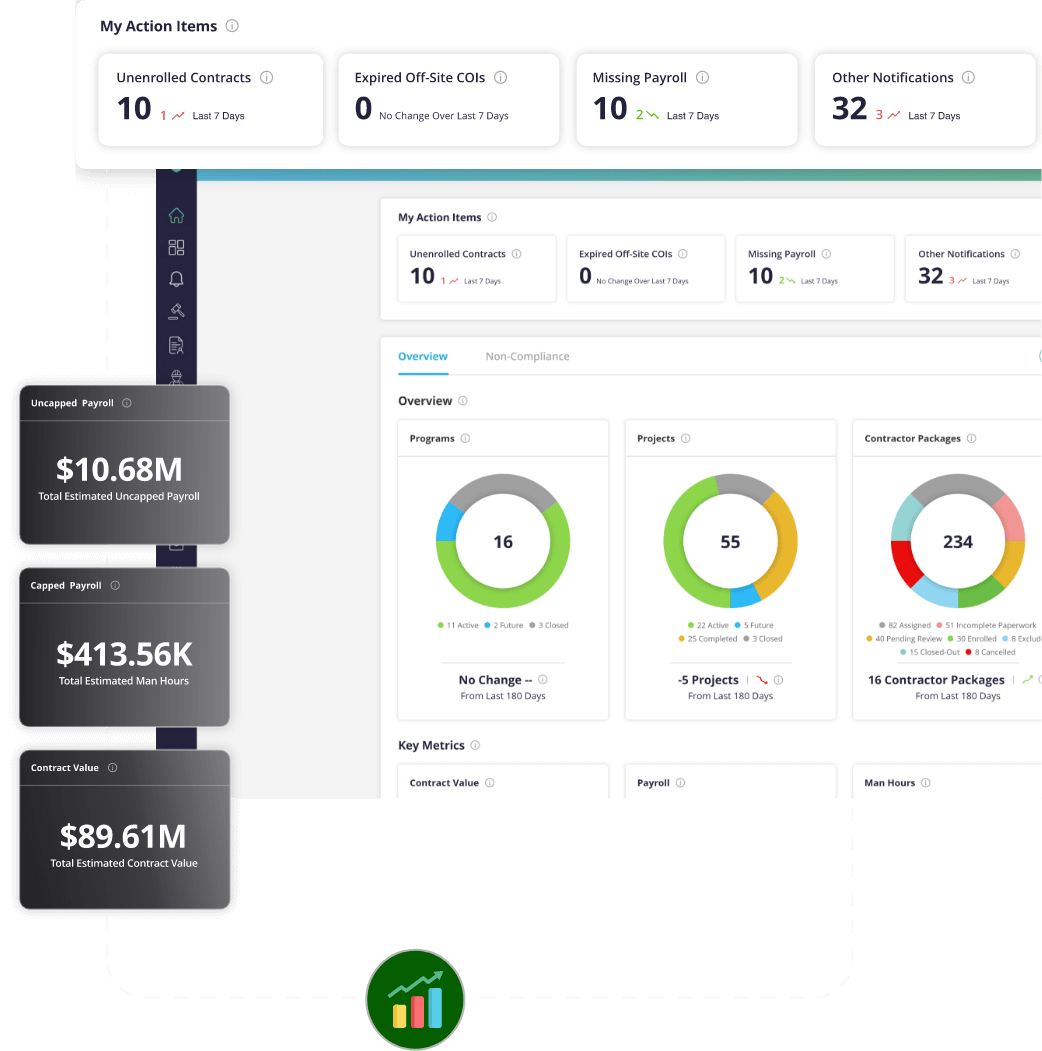

Automate enrollment, payroll, certificates, renewals, reports, and communication with the power of artificial intelligence.

Analyze and compare quotes, binders, policies, and contracts in an instant with the power of AI.

Quickly calculate a comprehensive Prequaligy Score to evaluate your contractors’ financial viability for any project.

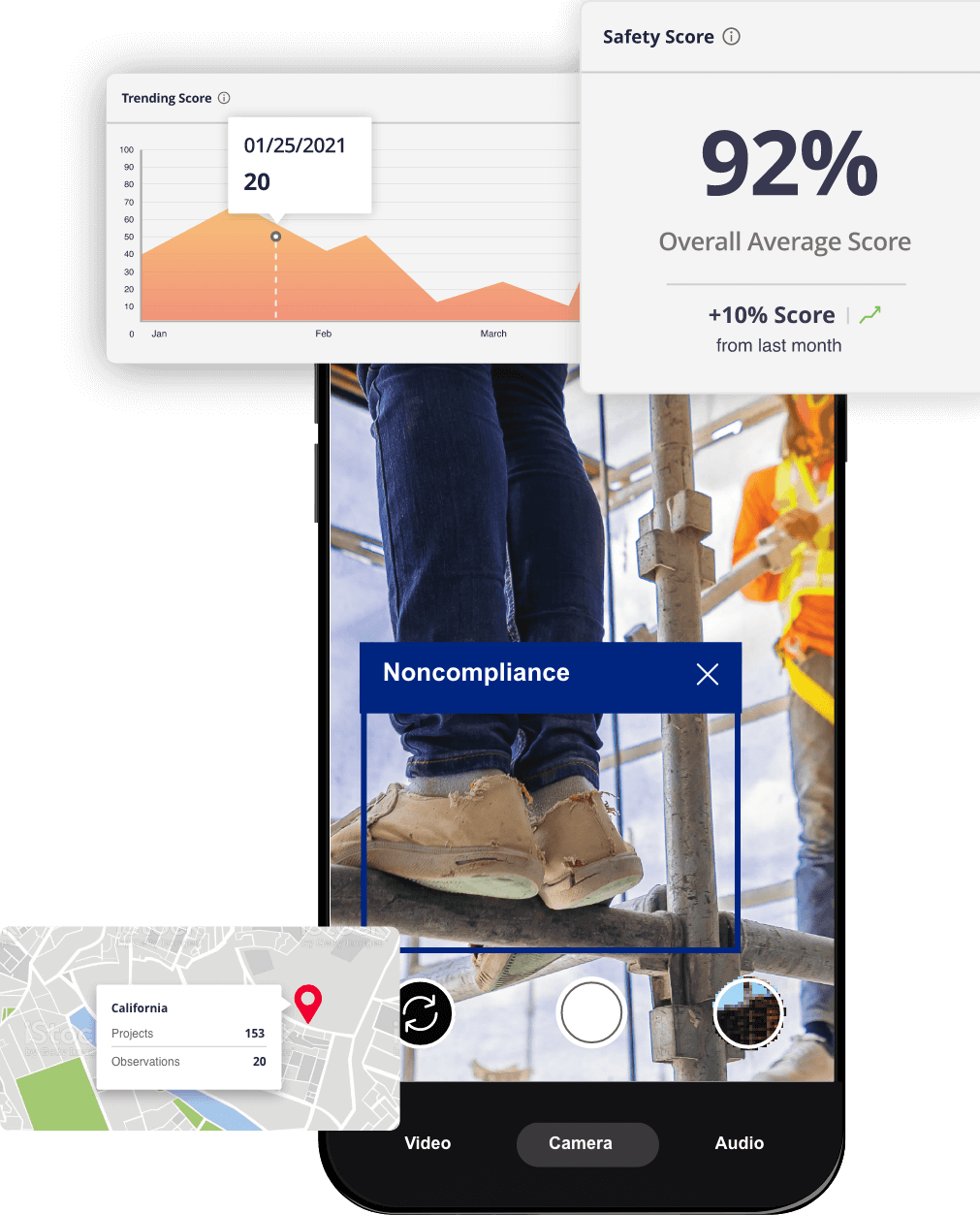

Complete inspections on the go by simply snapping a photo of jobsite hazards to instantly document risks without typing a single word.

Injala is the leading innovator in the insurance industry,providing insurance software solutions that are creating a transformational evolution in risk management.

Injala employs automation in all its insurance technology software solutions to eliminate the redundant, burdensome tasks of insurance administration and to provide valuable data for more accurate decision making.

For over 15 years, Injala has been partnering with giants of the insurance industry to deliver future-forward, evolutionary insurtech solutions that are changing the game.

With insurance in its DNA, Injala’s team is passionate about pushing the limits of cutting-edge insurance software technologyso that insurance administration is automatic, simple to use, cost-saving, and guided by data-driven decision-making. insurance software technology

Partnerships

We're not just looking to grow,

we're looking to evolve.