The insurance industry is undergoing an unprecedented transformation that is fueled by a digital revolution in the business and social environment. This demands a fundamental shift in the operating and business model being traditionally followed by the industry for ages. Insurance intermediaries play a vital role in the customer relationship lifecycle and acts as a front-office for the insurance industry. Without a doubt, insurance intermediaries will be impacted by this growing digitization in the industry.

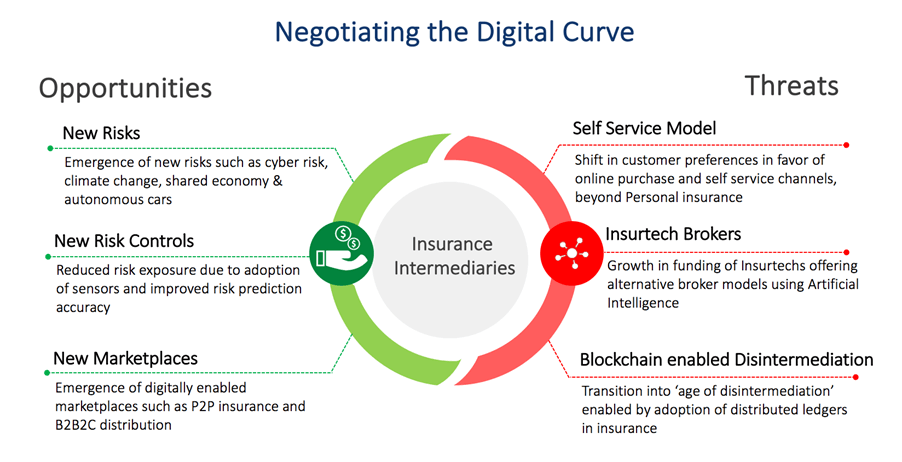

We believe that the revolution in insurance technology could be an opportunity or threat to you, depending on how you approach the business environment. We dissect this further as highlighted in the diagram below.

Agents and Brokers can decide their way forward by answering the following three questions:

Clearly, No. In the new world of high speed, digitized business process and data flow, insurance agents and brokers cannot afford to be the bottleneck. The insurance ecosystem is aggressively adopting new technology through custom developed software, management systems or third party platform providers. If insurance intermediaries do not keep up, it risks irrelevancy as customers and other participants in the insurance value chain are bound to find alternatives.

Many of the digital business models require close collaboration between entities. Insurance intermediaries act as a nodal point for customers, insurers and even reinsurers. They can use this to their advantage by leading the way ahead. For example - can the new technology work with organizations such as ACORD to define the standards for exchange of sensitive data? Can it 'host' a blockchain that will be consumed by various insurers and reinsurers?

The risk environment of tomorrow will be characterized by two themes:

a) New Risks. For example, climate change or renewable energy.

b) New methods to control risks. For example, driverless cars or water leak detectors.

Both can be excellent growth opportunities for insurance intermediaries. They can combine their risk management expertise with advanced technology to analyze new risks for their customers, as well as advise them on how to manage them.

Insurance intermediaries are a critical component of the industry. They have flourished so far because they have been able to lead the risk management lifecycle for their clients. The credit also goes to the fact that insurers/reinsurers do not have enough touchpoints with their insureds, hence are dependent on the intermediaries to understand customer needs and sell products. The rapid digitization in the industry is changing this. Insurance intermediaries will obviously have to improve the value proposition of risk advisory services to protect their position in the industry. But beyond that, they should evolve by proactively pursuing the growth opportunities presented by the digital wave in the industry. It remains to be seen how they respond.