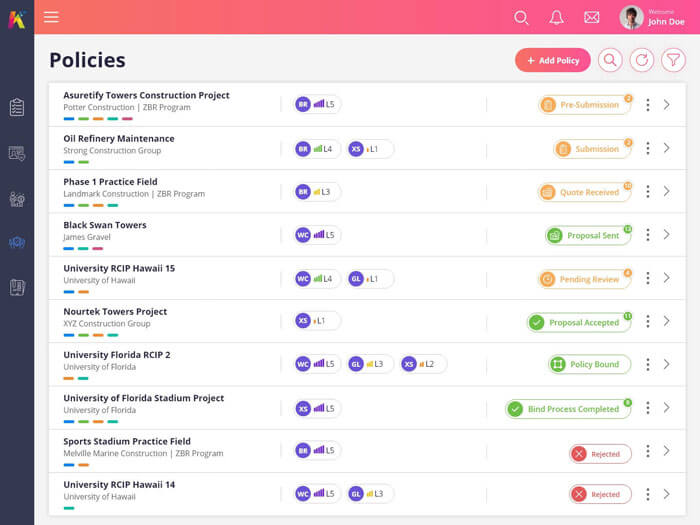

First, say goodbye to the annoying deja vu of entering data multiple times.

With Kinetic, project data is entered only once where it is then shared by all tasks.

Second, Kinetic’s single-entry data also improves accuracy,

which reduces the anxiety of having to crunch inconstant data.

Third, Kinetic automates mundane and repetitive administrative tasks

so you can focus on the business of insurance instead of the time-busting business of chasing data, filling out forms, writing reports, waiting for emails, returning phone calls. Isn’t that calming?